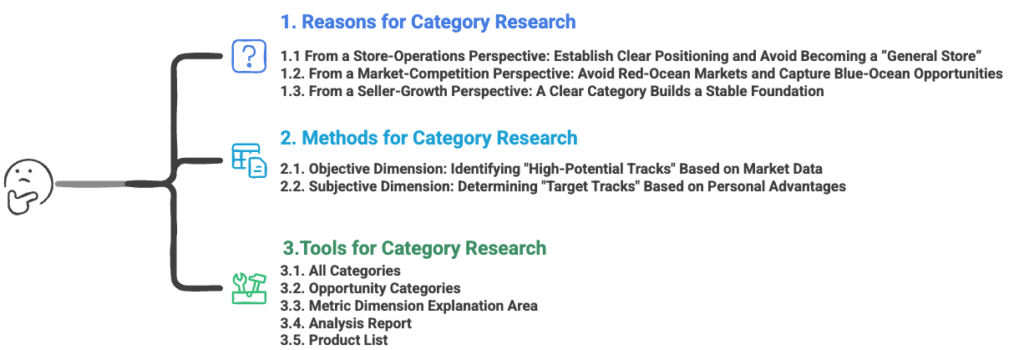

To help users systematically understand how to conduct category research, the following sections will walk you through each part of the framework step by step.

1. Reasons for Category Research

As e-commerce enters an era of refined and data-driven operations, conducting effective category research to select the right category is no longer a matter of “picking any industry to start with.” Category research has become a critical strategic decision that determines a store’s positioning, growth trajectory, and long-term competitiveness.

Thorough category research helps sellers establish a clear direction, streamline product strategy, and improve operational efficiency. In contrast, entering the wrong category often means starting on the wrong track—no matter how much effort is invested, growth will remain difficult.

Conducting category research and defining a clear category early brings three core advantages:

1.1. From a Store-Operations Perspective: Establish Clear Positioning and Avoid Becoming a “General Store”

- A vertical and well-defined subcategory helps a store build a clear identity and attract a more focused audience.

- It becomes easier to accumulate targeted followers, enhance brand recognition, and build customer loyalty.

- Subsequent activities—such as product selection, visual design, content marketing, and campaign planning—can all align with a single theme, creating compounding operational efficiency.

- In contrast, operating across multiple unrelated categories often results in a store with no distinctive identity, dispersed traffic, lower conversion rates, and ultimately diminishing visibility on the platform.

1.2. From a Market-Competition Perspective: Avoid Red-Ocean Markets and Capture Blue-Ocean Opportunities

- In red-ocean categories, top sellers dominate traffic and market share, leaving minimal room for new entrants.

- Blue-ocean subcategories offer lower competition, making it easier for new sellers to reach top rankings and benefit from natural traffic growth.

- Choosing the right blue-ocean category enables sellers to achieve higher market share and profitability at a lower operational cost.

1.3. From a Seller-Growth Perspective: A Clear Category Builds a Stable Foundation

- Defining a category early helps new sellers focus resources, avoid detours, and build momentum with confidence.

- A clear direction enables consistent operational rhythm, accelerating the accumulation of store authority and data—both essential for sustainable growth.

2. Methods for Category Research

Category research for selecting the right category is essentially choosing a market to start your business. This process can be approached from two dimensions: Objective Data Screening and Subjective Advantage Matching, which together help identify both promising and suitable target categories.

2.1. Objective Dimension: Identifying “High-Potential Tracks” Based on Market Data

Use data tools to scan the market, focusing on three core metrics to initially outline a list of potential categories:

- Market Demand Indicator: Reflects buyer size and consumption trends. Look for categories with high, stable, or continuously growing demand.

- Competition Indicator: Identifies the competitive stage of a category. Seek out categories in the early or middle stages of competition, not yet dominated by brands or major sellers.

- Market Fluctuation Indicator: Indicates the speed of market changes and assesses the ease of entering the market. High fluctuation often means that hierarchies are not yet solidified, making it easier for new sellers to penetrate with differentiated products. Opt for categories with moderate to high fluctuation rates, where new entries can more easily gain traffic and opportunities.

2.2. Subjective Dimension: Determining “Target Tracks” Based on Personal Advantages

Within the shortlisted potential categories, conduct a secondary screening based on personal circumstances to ensure you can both manage and excel:

- Supply Chain Advantage: Sellers with stable supply chains, price advantages, or unique products have an edge in standing out within a category. Choose categories where you can secure good prices, stable supplies, or differentiated products.

- Interest and Insight: If a seller has a genuine interest, understanding, or sensitivity towards a particular category, they are likely to perform better in product selection, content creation, and operations. Find a category that not only shows market potential but also aligns with your interests and strengths, making it easier to persist and delve deeper into the field.

3. Tools for Category Research

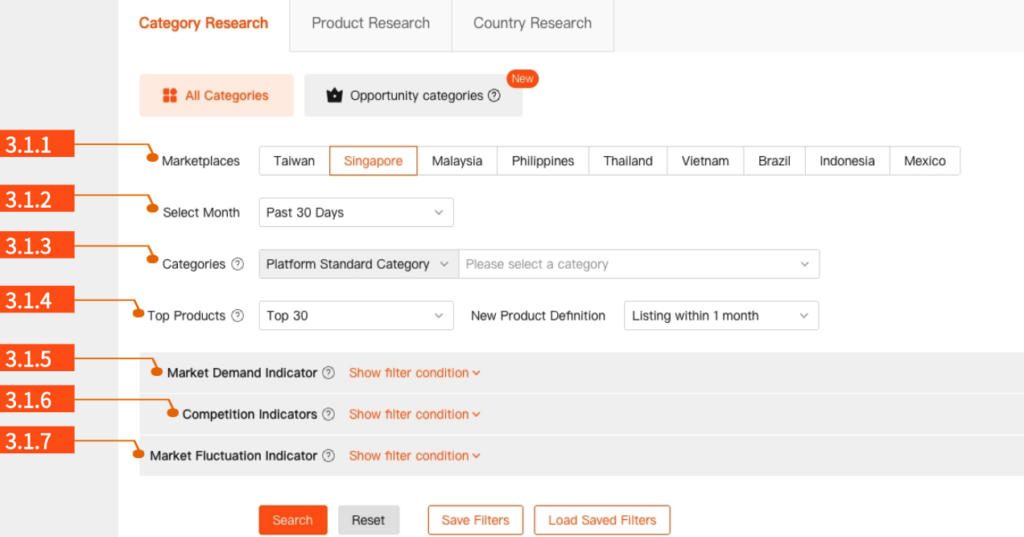

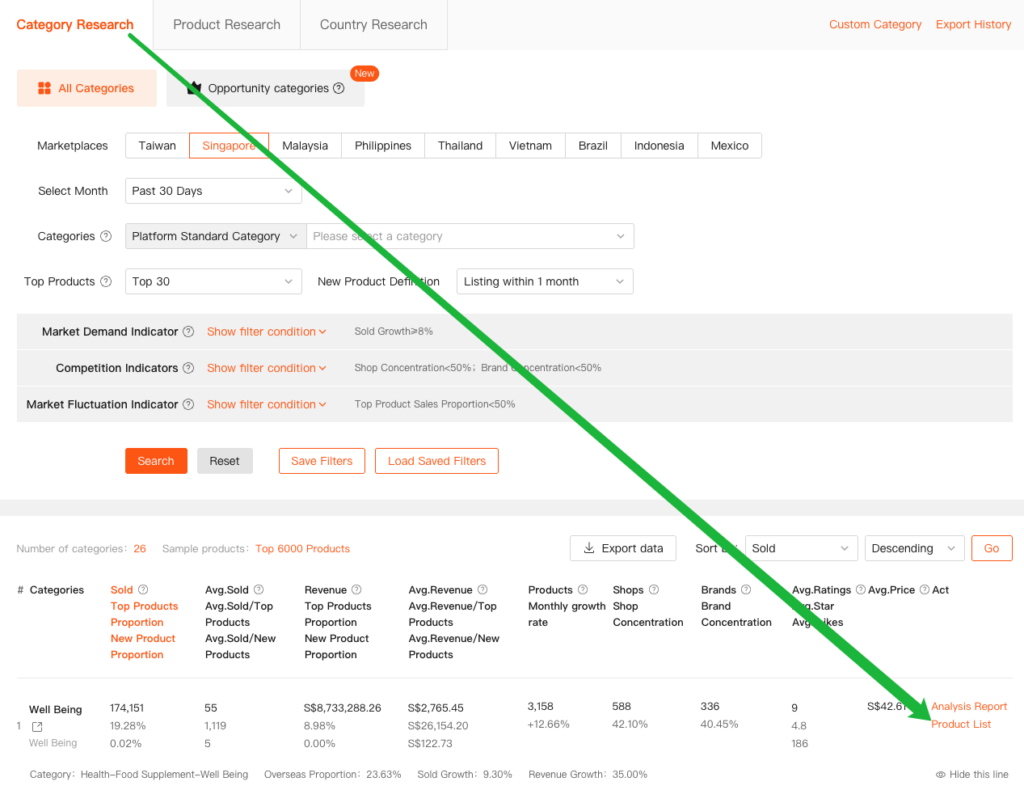

Shopdora’s Category Research tool includes two modules: All Categories and Opportunity Categories.

For each subcategory, the tool builds a comprehensive operational dataset by analyzing products with sales records and the top 6,000 best-selling products—ensuring accurate, actionable insights into market performance.

3.1. All Categories

3.1.1 Marketplace

Supports 9 major markets: Taiwan, Singapore, Malaysia, Philippines, Thailand, Vietnam, Brazil, Indonesia, Mexico.

3.1.2 Select Month

Supports viewing data from Past 30 Days or Monthly data.

3.1.3 Categories

Select a category or subcategory using one of the following methods: Platform Standard Category or Custom Category.

- Platform Standard Category(Click to View Details):

The official Shopee category used when uploading products. It includes up to 5 category levels and fully aligns with Shopee’s platform category structure. - Custom Category(Click to View Details):

A user-defined category created by the users. Users can group relevant products into this customized category to support flexible and personalized operational analysis.

3.1.4 Top Products

Refers to high-value, representative products ranked by sales within the selected category. By default, the top 30 products are shown, but this can be adjusted to show the top Top 50, Top 80, or Top 100.

3.1.5 New Product Definition

Refers to products newly listed within a recent time range.

The default setting is Listing within 1 month, and can be adjusted to:

Listing within 3 months, Listing within 6 months, or Listing within 12 months.

3.1.6 Market Demand Indicator

Used to evaluate the size and trends of market demand. Monitoring changes in demand helps users identify market opportunities early.

3.1.7 Competition Indicators

Used to Analyze the competitive landscape through Shops and Brands data, revealing market concentration and monopolistic tendencies.

3.1.8 Market Fluctuation Indicator

This indicator assesses the difficulty for new sellers to enter the market.

It compares the proportion of Top Products and New Products to estimate market volatility.

High volatility indicates low monopoly and more opportunities for new products—but also signals unstable demand and potentially unstable profit.

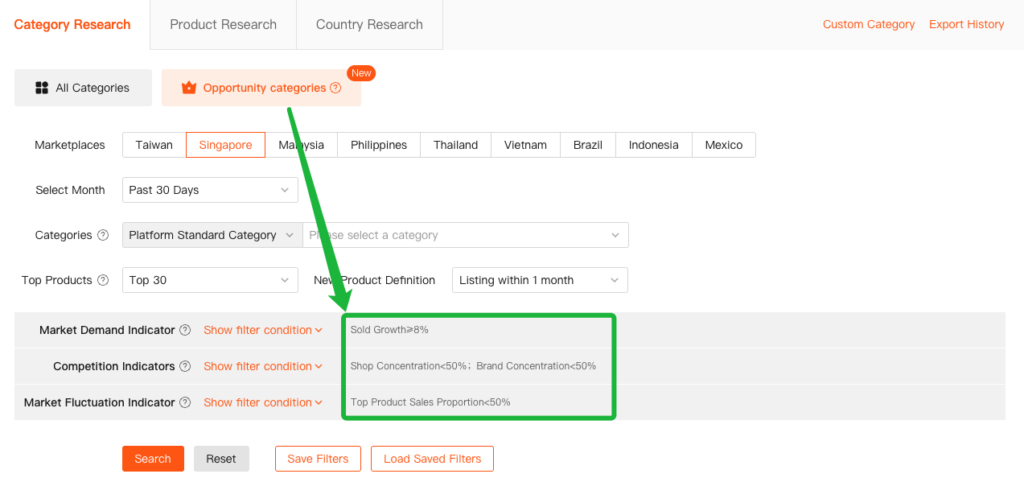

3.2. Opportunity Categories

Shopdora provides pre-defined, standardized criteria for “Opportunity Categories”. Users can use these default settings as a baseline and further adjust their own filtering conditions as needed.

The standardized definition is as follows:

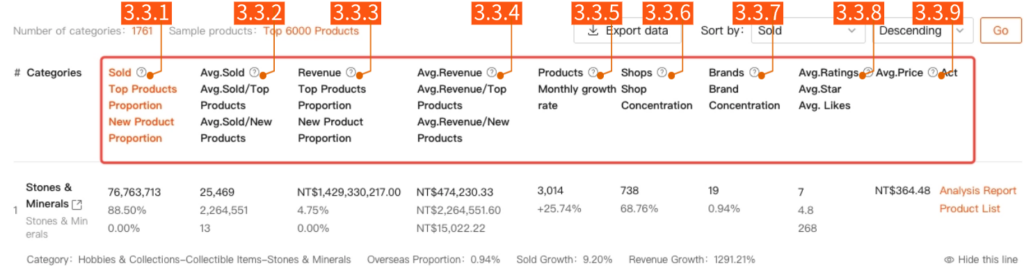

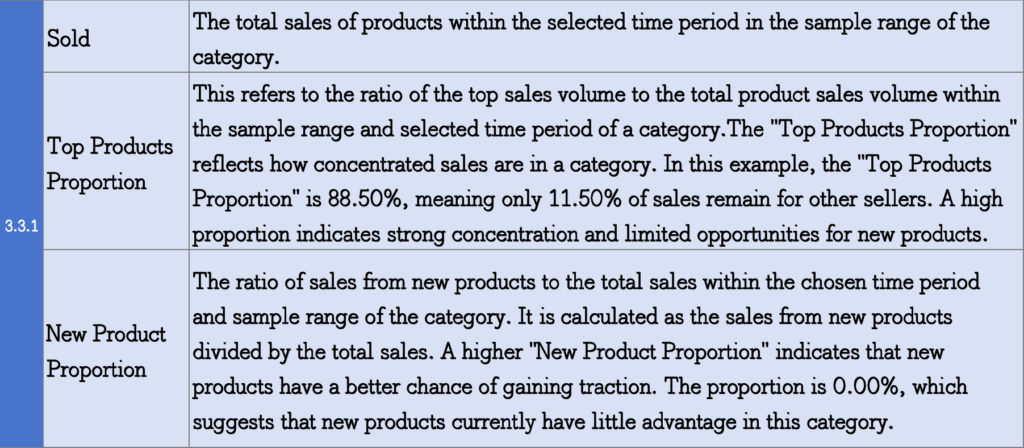

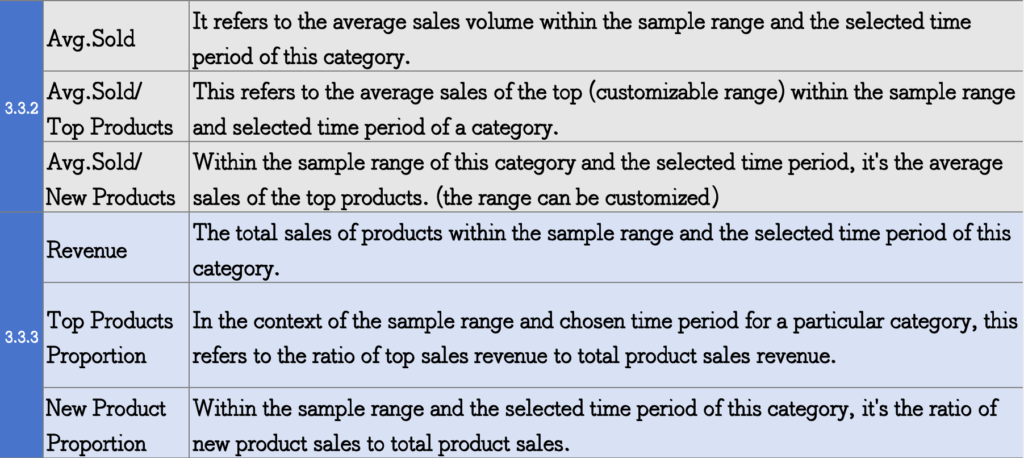

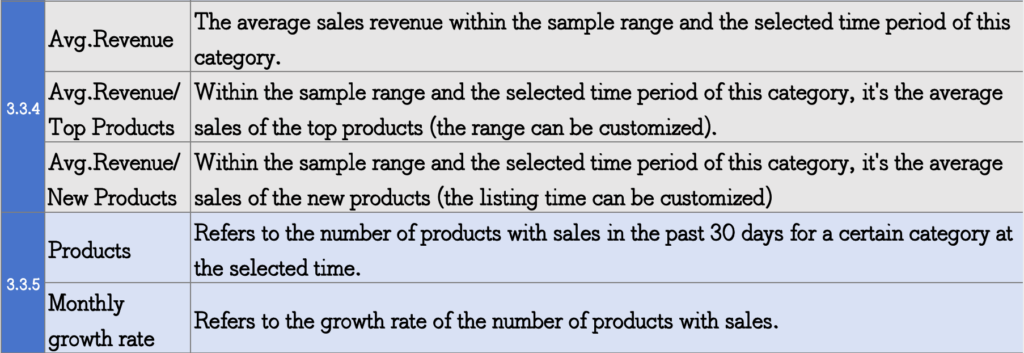

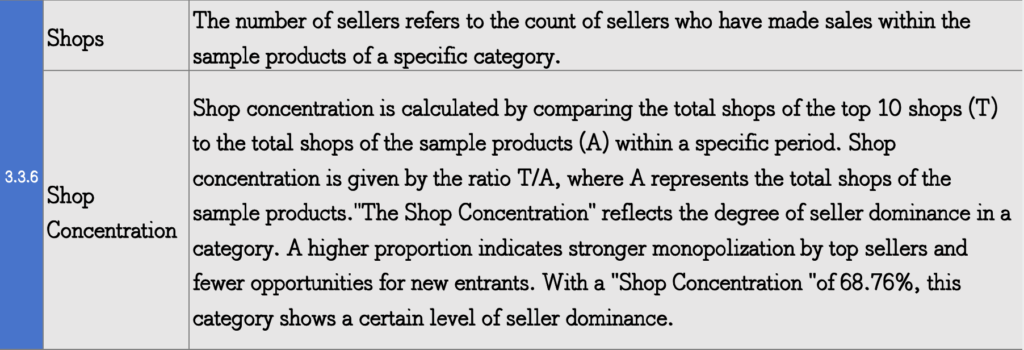

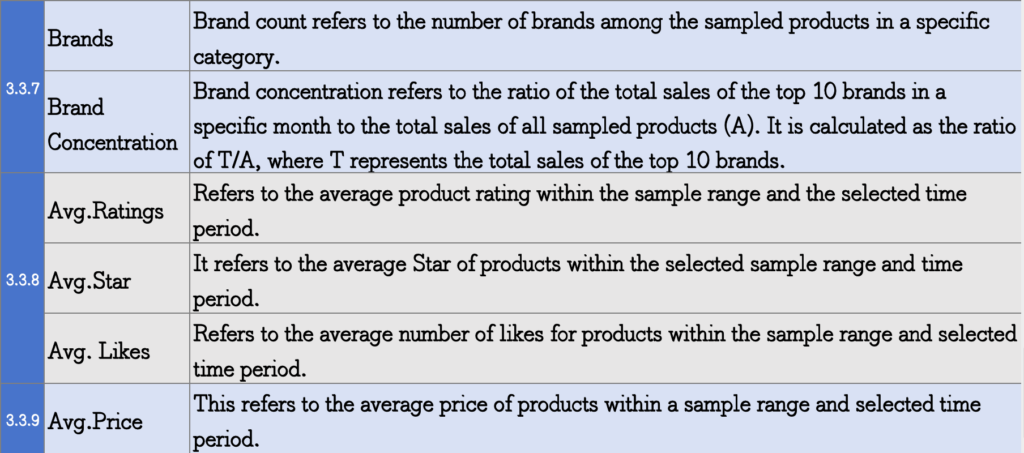

3.3. Metric Dimension Explanation Area

3.4. Analysis Report

Click Category Trends Analysis Report to view detailed information about the Analysis Report.

3.5. Product List

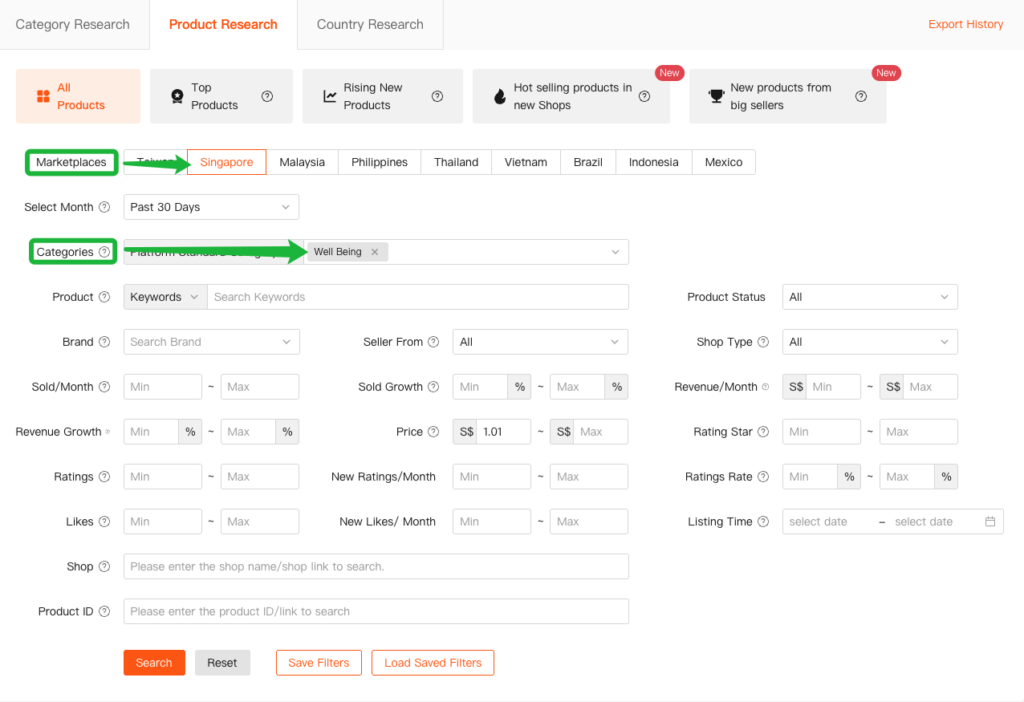

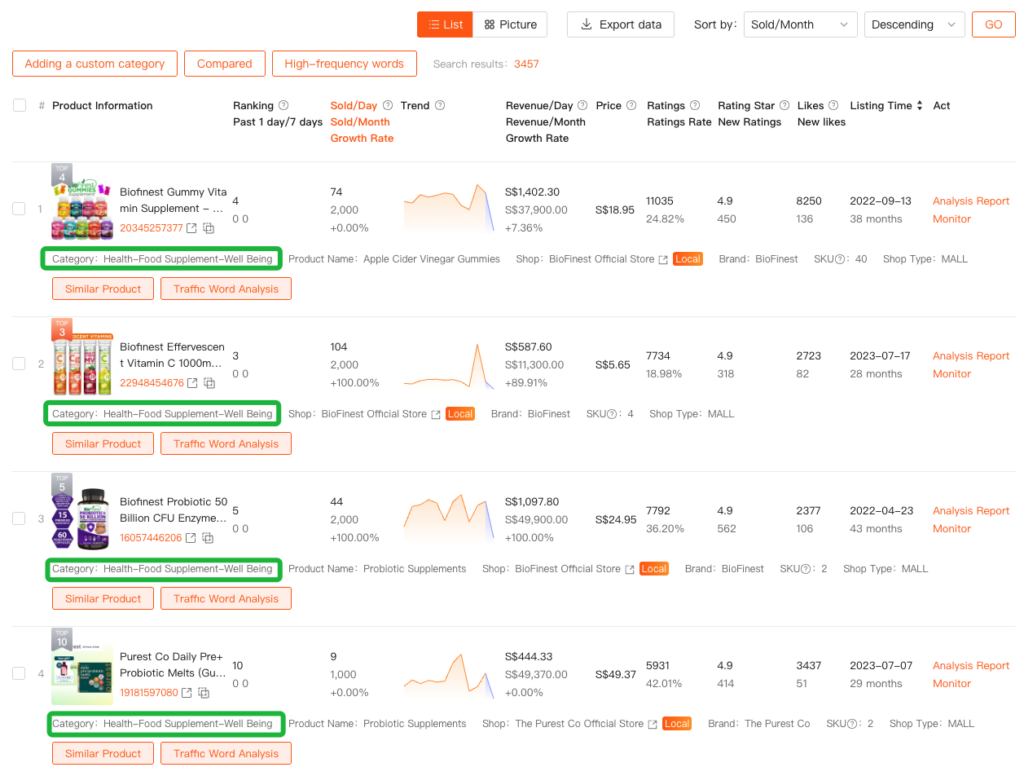

When you click Product List, the system will automatically navigate to the Product Research page and pre-fill the corresponding Marketplaces and Categories. This allows you to directly view all products under the selected marketplace and category without additional manual input.